Blog

As members of the HERS Rating community, we are very excited about the recent study conducted by Freddie Mac determining that homes rated under RESNET’s Home Energy Rating System (HERS) between 2013 and 2017 sold for an average of 2.7% more than comparable unrated homes.

As members of the HERS Rating community, we are very excited about the recent study conducted by Freddie Mac determining that homes rated under RESNET’s Home Energy Rating System (HERS) between 2013 and 2017 sold for an average of 2.7% more than comparable unrated homes.

Using a national random sample, the property value analysis found that better-rated homes are sold for 3 – 5% more than lesser-rated homes. In this case the “better” rating means a higher energy efficiency rating. It’s unclear from the study if this means a home with an average HERS rating, such as HERS 55 in the Northeast, could be valued at 2.7% more than the unrated home. And perhaps one approaching Zero Energy, such as HERS 10, could be valued at 5% more than the lower-rated home. I could be doing some very creative math here, but doesn’t that imply that the better rated home might just be valued about 7.7% more than the unrated home?

Unfortunately, the loan performance analysis shows the default risk of the rated homes is no different than the unrated homes once the borrower and underwriting characteristics are factored-in. This could be indicating that real estate and finance professionals don’t have the tools they need to effectively value these homes. However, the loans that do have ratings appear to also have a lower delinquency rate than those for unrated homes.

Let’s do some creative math again! If I decide to build a high performance, HERS rated home, I might save $50/month on utilities. If I apply that savings to an overpayment on my 30-year mortgage of $320k, I will save $17,000 over the life of the mortgage. What if I’m the buyer of a new, HERS rated home and I’ve now spent about $12k more for the value added from the rating. Well, my utility savings of $50/month will still cover that premium and I’ll pocket about $5k more over the life of the 30-year mortgage.

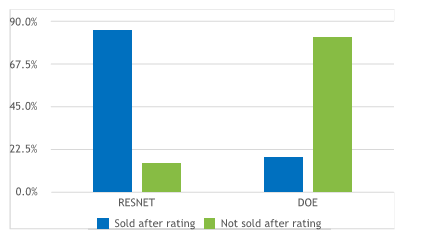

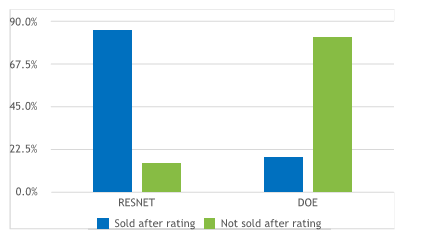

It’s hard to know from this graph whether more spec homes were built with a HERS rating and more custom homes pursued DOE Zero Energy Ready certification, but it appears DOE ZER homes are hard to part with since fewer were sold after the rating! So, while we know we buy on emotion (and location), apparently, we’re also emotionally attached to our high-performance homes!

This Freddie Mac study is exciting and encouraging, but let’s build upon this by including the inherent benefits of living in a healthy home. Health and well-being are directly affected by our built environment; putting a price tag on fewer missed work and school days and fewer doctor visits will help demonstrate the value of high-performance buildings. Read more about the study here.

Contributor: Karla Butterfield, Sustainability Director

Steven Winter Associates